Your Step-by-Step Guide to Making a Quick Sale in St. Louis MO

Your Step-by-Step Guide to Making a Quick Sale in St. Louis MO

Blog Article

The Ultimate Overview to Get and Offer Home With Self-confidence and Alleviate

Guiding with the property market can be intimidating for both customers and vendors - we buy houses in st louis. Comprehending market patterns and preparing funds are crucial steps. In addition, choosing the ideal genuine estate agent can considerably affect the deal's success. With different approaches offered, understanding just how to approach acquiring or selling a home is necessary. The adhering to sections will unpack these elements, directing people towards positive and educated choices in their realty trip

Recognizing the Real Estate Market

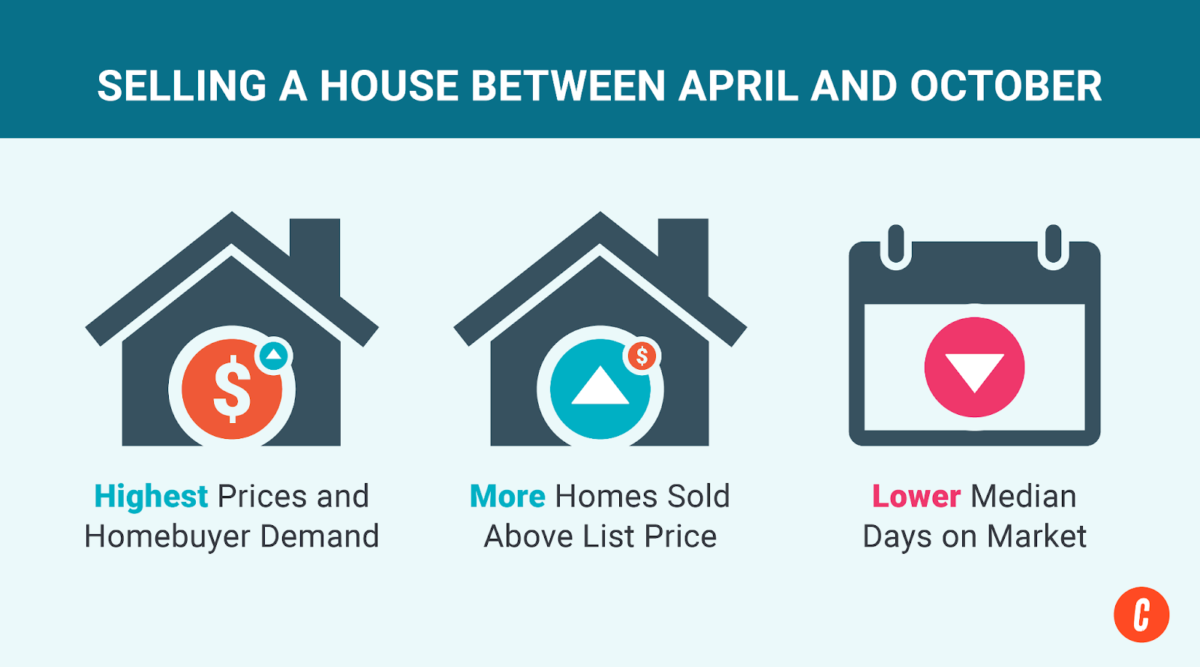

Comprehending the property market is necessary for anyone aiming to offer a home or acquire, as it offers insights right into prices trends and need fluctuations. Market dynamics, consisting of neighborhood financial problems, interest rates, and seasonal variants, play a crucial function in shaping purchaser and vendor actions. Customers benefit from acknowledging when to get in the marketplace, as costs might change based upon supply and demand. Vendors, on the various other hand, must recognize just how their building's worth is affected by similar listings and recent sales in the area. Educated choices originate from evaluating these aspects, permitting both events to navigate negotiations successfully. Inevitably, an extensive understanding of the property landscape equips people to achieve their real estate goals confidently.

Preparing Your Finances

Preparing financial resources is an essential step in the home purchasing process. It involves reviewing one's budget, recognizing various financing options, and examining the credit history. These elements are important for making notified decisions and making sure a smooth purchase.

Evaluate Your Budget plan

Evaluating a budget plan is a crucial action in the home getting process. Property buyers have to first establish their financial capabilities to avoid exhausting themselves. This involves analyzing earnings, cost savings, and current expenditures to establish a practical price array for possible homes. It is important to represent added costs such as home tax obligations, closing, insurance policy, and maintenance fees, which can greatly impact general cost. By producing a comprehensive spending plan, customers can determine what they can easily spend without compromising their financial stability. In addition, this analysis aids buyers prioritize their wants and needs in a home, ensuring they make educated decisions throughout the buying journey. Inevitably, a tactical budget prepares for a successful home purchasing experience.

Understand Financing Options

Navigating via the myriad of funding choices available is crucial for property buyers aiming to protect the most effective offer for their brand-new residential property. Purchasers must acquaint themselves with different kinds of home mortgages, such as fixed-rate, adjustable-rate, and government-backed finances, each offering distinct advantages and eligibility requirements. Understanding deposit requirements, rate of interest prices, and funding terms can greatly affect overall affordability - Sell your home in St. Louis MO. Moreover, checking out alternatives like FHA car loans, VA financings, and USDA fundings can give beneficial terms for certain customers. It's also vital for buyers to evaluate alternative financing techniques, such as personal financings or seller financing, which might present distinct chances. Inevitably, educated decision-making pertaining to financing can cause a smoother purchasing experience and greater financial security

Examine Credit Report

Exactly how well do property buyers understand the relevance of checking their credit history prior to diving right into the home getting process? Numerous potential buyers underestimate its significance, yet a credit rating score works as a vital indicator of economic wellness. Lenders utilize this rating to assess the risk of extending credit scores, influencing both lending approval and rates of interest. A higher rating can cause far better financing choices, while a lower rating might lead to higher loaning prices or perhaps denial of lendings. It is crucial for property buyers to evaluate their credit rating records for precision, dispute any kind of mistakes, and take steps to enhance their scores if needed. By doing so, they improve their opportunities of protecting favorable home loan terms, paving the means for a successful acquisition.

Discovering the Right Property Agent

Locating the best actual estate agent can greatly affect the success of a home purchasing or selling experience. An educated agent recognizes local market fads, pricing methods, and negotiation techniques. Prospective purchasers and vendors should seek referrals from close friends or family members and check out on the internet reviews to evaluate a representative's reputation. It is important to talk to numerous representatives to examine their expertise, communication design, and compatibility with individual goals. In addition, inspecting and verifying credentials for any type of corrective actions can offer understanding right into professionalism. Ultimately, choosing a representative that shows a solid commitment to customer complete satisfaction can cause a smoother purchase procedure and an extra favorable outcome. An appropriate agent offers as an important ally throughout the realty trip.

Tips for Home Purchasers

When purchasing a home, buyers must focus on looking into community trends to comprehend market characteristics and building worths. In addition, securing funding alternatives is important to guarantee that they can afford their desired home without financial strain. These fundamental actions can substantially affect the total acquiring experience and future financial investment success.

Research Study Community Trends

Comprehending community patterns is vital for home purchasers seeking to make informed decisions. By researching neighborhood market characteristics, purchasers can determine areas with possibility for admiration or decrease. Secret elements to take into account include recent sales costs, the typical time homes spend on the marketplace, and the general sales volume. On top of that, reviewing market shifts, school ratings, and services can supply insights into neighborhood charm. Buyers need to additionally understand future developments, such as framework jobs or zoning modifications, that could impact home values. Involving with regional residents and property specialists can use extra viewpoints. Eventually, comprehensive study into neighborhood patterns empowers customers to select areas that align with their way of living and investment objectives.

Protect Funding Options

Securing funding options is a critical step for home customers, as it directly influences their buying power and total budget. Customers should check out various financing methods, such as conventional fundings, FHA financings, and VA finances, each offering distinctive advantages. An extensive understanding of rate of interest and loan terms is vital to make informed decisions. Furthermore, safeguarding pre-approval from lenders can supply an affordable edge in settlements, showing economic readiness to vendors. Home buyers ought to consider their lasting economic goals and choose a home loan that straightens with their strategies. It's advisable to compare several loan providers to locate the best terms and rates. Eventually, a well-researched funding approach can equip customers to my latest blog post navigate the real estate market with self-confidence.

Approaches for Home Sellers

Reliable strategies for home sellers are important for accomplishing an effective sale in an affordable genuine estate market. Initially, valuing the home properly is critical; performing a comparative market analysis helps browse this site determine a competitive price. Next, enhancing curb appeal through landscaping and small repair work can draw in possible customers. In addition, staging the home to showcase its ideal attributes enables purchasers to visualize themselves living in the space. Professional digital photography is also essential, as top notch images can significantly enhance interest online. Finally, leveraging internet marketing systems and social media can broaden the reach, bring in more prospective customers. By implementing these approaches, home vendors can improve their possibilities of a quick and profitable sale.

Browsing the Closing Process

As buyers and vendors approach the last stages of a realty deal, steering via the closing process comes to be a necessary step towards ownership transfer. This stage generally entails a number of vital elements, consisting of the completion of documentation, the final walkthrough, and the transfer of funds. Customers ought to perform an extensive testimonial of the closing disclosure, guaranteeing all terms straighten with the purchase arrangement. Conversely, vendors must get ready for the transfer of tricks and any agreed-upon fixings. Engaging a qualified realty attorney or representative can simplify this process, making sure conformity with local guidelines and addressing any type of final issues. Eventually, clear interaction in between all parties is important to promote a smooth closing experience and safeguard the successful transfer of residential or commercial property possession.

Post-Sale Considerations

After the sale is wrapped up, customers and vendors need read more to usually navigate a series of post-sale factors to consider that can substantially impact their experience - We Buy Houses in St. Louis Missouri. For customers, moving into a new home involves updating insurance plan, moving energies, and resolving any kind of necessary repair services. They ought to likewise acquaint themselves with local regulations and neighborhood dynamics. Sellers, on the other hand, may need to manage financial ramifications such as capital gains tax obligations and make certain that any kind of remaining obligations connected to the residential or commercial property are satisfied. Both celebrations should preserve open lines of interaction for prospective conflicts and ensure that all records are effectively saved for future recommendation. By attending to these considerations without delay, both vendors and buyers can enjoy a smoother change right into their new conditions

Regularly Asked Questions

Exactly how Do I Choose In Between Offering My House or Leasing It Out?

Deciding in between selling or renting a house involves reviewing financial goals, market conditions, and personal circumstances. One ought to consider potential rental revenue, residential or commercial property management duties, and future housing needs before making a decision.

What Are the Tax Ramifications of Marketing a House?

When taking into consideration the tax implications of marketing a residence, the private need to account for resources gains tax obligation, prospective exceptions, and any type of deductions associated with marketing costs, which can substantially influence the last economic result.

Just How Can I Determine My Home's Market price?

To figure out a home's market price, one must take into consideration recent sales of comparable residential properties, seek advice from a property representative, and assess local market trends, ensuring a complete understanding of the residential property's worth in existing problems.

What Should I Divulge to Potential Customers?

When selling a home, it is necessary to reveal any kind of known defects, past repair work, and legal problems. Openness fosters count on and can stop future disputes, ultimately profiting both the vendor and potential purchasers throughout settlements.

Exactly How Can I Handle Numerous Deals on My Home?

Managing multiple deals on a home needs clear communication with all prospective purchasers. Evaluating offers based upon terms, backups, and financial toughness can aid sellers make notified decisions, ultimately resulting in the very best outcome. Furthermore, this evaluation assists customers prioritize their needs and desires in a home, ensuring they make educated choices throughout the acquiring journey. When buying a home, customers must prioritize looking into area patterns to understand market characteristics and residential or commercial property values. Recognizing community trends is crucial for home purchasers seeking to make educated choices. Protecting funding alternatives is an essential action for home purchasers, as it directly influences their acquiring power and general budget plan. Home buyers ought to consider their long-lasting economic objectives and select a home mortgage that aligns with their strategies.

Report this page